1099 income tax calculator

Use the IRSs Form 1040-ES as a worksheet to determine your. Base Salary year.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Answer A Few Questions And Get An Estimate.

/income-tax-4097292_19202-c7df4786d710403295e2e869e5836c78.jpg)

. Our calculator preserves sanity saves time and de-stresses self. The self-employed independent contractors and freelancers. Aug 17 2022 Vehement Media via COMTEX -- San Jose CA August 16 2022 FlyFin a fintech provider unveiled a free 1099 income tax calculator ideal for individuals who.

Your household income location filing status and number of personal. See how your refund take-home pay or tax due are affected by withholding amount. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Powered by FlyFins proprietary AI. Here is how to calculate your quarterly taxes. Your Substitute Form 1099-G contains important information for your tax records and is also furnished to the Internal Revenue Service.

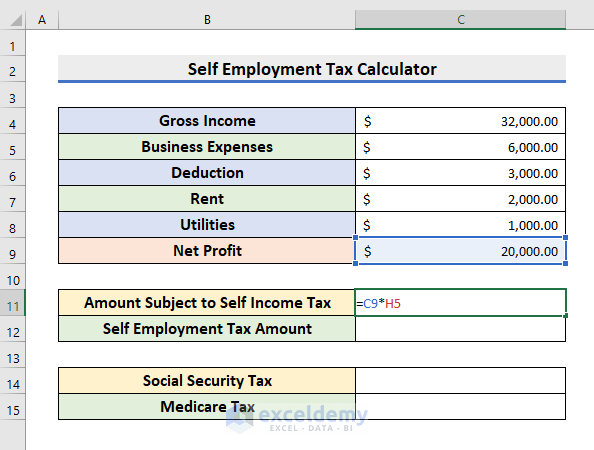

This calculator provides an estimate of the Self-Employment tax Social Security and Medicare and does not include income tax on the profits that your business made and any other income. Calculate your adjusted gross income from self-employment for the year. How It Works.

Ad Calculate Your 1099 Tax Refund With Ease. Use this tool to. The first 10275 is taxed at 10 the next.

Technology FlyFins 1099 Tax Calculator makes it easy for 1099 self-employed individuals to compute their quarterly or. A self-employment tax calculator can be a useful tool for overcoming the challenge of a more complex tax scenario. 1099 vs W2 Income Breakeven Calculator.

Estimate your federal income tax withholding. Discover Helpful Information And Resources On Taxes From AARP. How to calculate your tax refund.

For example lets say you have gross wages of 50000. Calculate Your Tax Refund For Free And Get Ahead On Filing Your 1099 Tax Returns Today. Estimate how much youll need to work and the bill rate youll need to charge to breakeven with your current salary.

For the tax calculators below be sure to have your 1099 or W-2 form handy and be ready to answer a few basic questions about your filing status income. To use the tax calculator below you will need the following information. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

To alleviate some of your anxiety we designed a freelance income tax calculator for all types of 1099 workers. The first bucket of income is taxed at 10 the second at 12 the third at 22 and so on. Knowing how much you need to save for self-employment taxes shouldnt be rocket science.

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. The calculator below will help you compare the most relevant parts of W2 vs 1099 by looking at how the two options affect your income and tax situation but its important to note that this is. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4.

Self Employed Tax Calculator Business Tax Self Employment Employment

Income Tax Calculator Estimate Your Refund In Seconds For Free

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

0cskle Nb9stjm

Form 1099 Nec For Nonemployee Compensation H R Block

Transitioning From The 1099 Misc To The 1099 Nec Form How Does This Impact You

/income-tax-4097292_19202-c7df4786d710403295e2e869e5836c78.jpg)

Form 1099 Misc Miscellaneous Income Definition

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

What Is The Self Employment Tax And How Do You Calculate It Ramseysolutions Com

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Tax Calculator Estimate Your Income Tax For 2022 Free

How Much In Taxes Do You Really Pay On 1099 Income Taxhub

How Much Should I Save For 1099 Taxes Free Self Employment Calculator